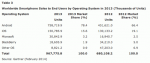

2013 was the year when the inevitable happened: worldwide sales of smartphones surpassed sales of the more basic (and generally cheaper) feature phone devices for the first time, according to Gartner’s latest market estimates – with 968 million smartphone device units sold to end users in 2013 out of a total of 1.8 billion mobiles sold.

That overall global mobile device total was up 3.5% on 2012′s figure.

The smartphone vs feature phone tipping point was reached in Q2 last year, according to the analyst, when Gartner previously noted smartphones had outstripped dumbphone sales globally for the first time. At that point Android was taking a 79% marketshare.

Now, looking at 2013 performance as a whole, Gartner said sales of smartphones accounted for 53.6% of overall mobile phone sales for the year — cementing their majority position vs feature phones.

Smartphone sales grew 36% in Q4, taking a 57.6% share of overall mobile phone sales in the fourth quarter, up from 44% year-over-year. That’s slightly lowered growth than smartphones were seeing in Q2 (46.5%) but sales of smarter portable handsets which let users download third party apps still outstripped sales of dumber mobiles throughout the year.

Gartner notes that mobile sales in saturated mature regions fell due to weaker demand during 2013, with emerging markets providing the engine for growth.

Smartphone growth for the year was led by adoption in Latin America (which had a 96.1% regional growth rate), the Middle East and Africa, Asia/Pacific and Eastern Europe, where Gartner notes sales grew by more than 50% in Q4.

The country with the highest individual smartphone sales growth was India, which exhibited a 166.8% increase in Q4. China also contributed significantly to global smartphone sales with a rise of 86.3% in sales during 2013.

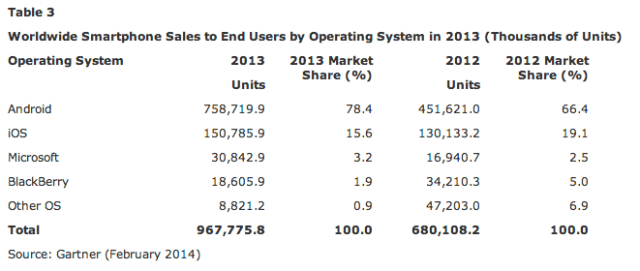

Gartner pegged the still growing Android OS’s 2013 global marketshare at 78.4%; vs 15.6% for a continuing to shrink in marketshare iOS; and just 3.2% for Microsoft’s Windows Phone platform (although the ‘third ecosystem’ grew its global share). BlackBerry shrank to a marginal 1.9%.

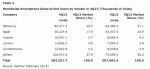

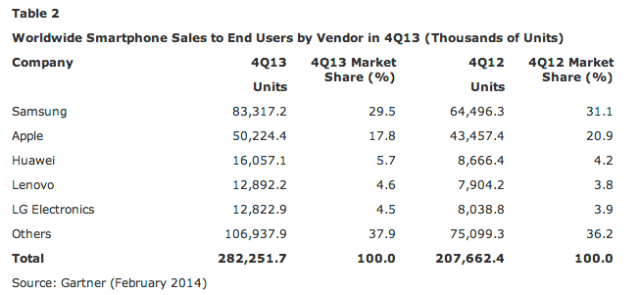

In terms of the top smartphone vendors in Q4, Samsung still leads — taking a 29.5% share in the quarter, although that’s down on the year on year quarter when it bagged 31.1%.

Apple’s second placed share — of 17.8% for Q4 — is also down on Q4 2012 ,when Cupertino took just over a fifth (20.9%).

Gartner’s market data gives third place in Q4 to China’s Huawei, with 5.7% of the market, up from 4.2% in the year ago quarter:

Developing…