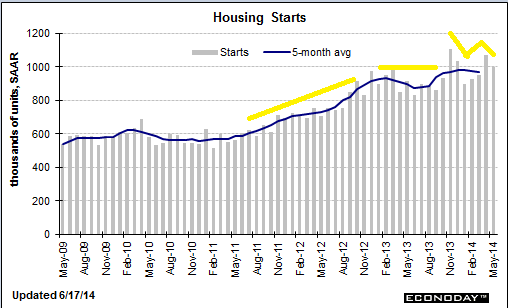

Same pattern- down some for the winter, up some, then backing off some.

If this is in fact what’s happening, Q2 GDP could be up less than 3%, and 2014 sub 2%, or even sub 0, if the demand leakages are allowed to keep the upper hand and a fiscal adjustment isn’t made.

“The Business Roundtable survey showed chief executives forecast GDP growth of 2.3 percent in 2014, down from last quarter’s estimate of 2.4 percent for the year.”

“Federal Reserve Chair Janet Yellen said last month there was a risk a protracted housing slowdown could undermine the economy.”

Housing Starts

Highlights

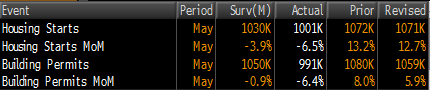

Housing took a step back in May. Starts fell a monthly 6.5 percent but followed a strong 12.7 percent spike in April. The 1.001 million unit pace was up 9.4 percent on a year-ago basis and fell short of expected 1.036 million units.

Single-family starts dropped 5.9 percent after a 4.6 percent rise. Multifamily starts declined 7.6 percent, following a 29.2 percent spike in April.

Building permits followed a similar pattern, suggesting some moderation in construction. Permits fell 6.4 percent after a 5.9 percent rise in April. Permits posted at 0.991 million units and were down 1.9 percent on a year-ago basis. Analysts forecast 1.062 million units.

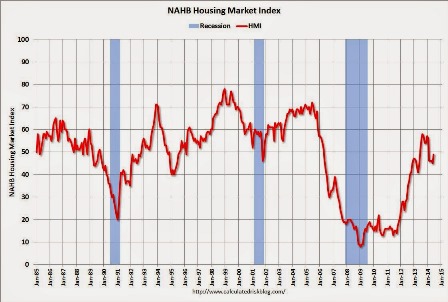

Builder was up some, but has remained below 50 for 5 months, and by historical standards remains dismal:

Industrial production/manufacturing was up some yesterday, but it’s a relatively small part of the economy and seems to chug along at 3-4% annual growth rates.

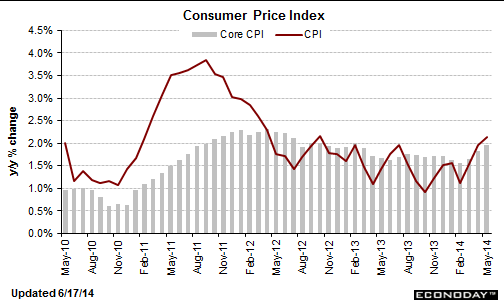

“The core CPI was lifted by a 0.3 percent rise in rent. There were also increases in medical care costs, apparel, new cars prices and airline fares.”

This doesn’t read to me like an ‘excessive demand problem’ that higher rates would reverse. But that’s just me. I agree the Fed may think otherwise!