A tsunami of disruption - courtesy of Bitcoin - is headed directly for several sectors of the financial services industry.

A tsunami of disruption - courtesy of Bitcoin - is headed directly for several sectors of the financial services industry.

Some of these companies may adapt to a world in which the digital currency plays a major role, but most are likely to become Bitcoin market victims - companies that will struggle and possibly disappear altogether.

In a research report released at the end of May, Wedbush Securities analyst Gil Luria said "Bitcoin-related technologies will disrupt payments markets and other trust-based markets within the next few years and for decades to follow."

This could have a tremendous impact on the U.S. economy, Luria said, as 20% of the nation's gross domestic product (GDP) "is generated by industries whose main function is as a trusted third party," such as banks, insurance carriers, and real estate-related companies.

In dollar terms, that's an eye-popping $3.4 trillion.

And while it won't happen overnight, the changes will be felt far and wide. Likening Bitcoin to other revolutionary technologies like the Mobile Wave of smartphones and tablets and social media, Luria predicts "the disruption from Bitcoin will take longer than expected but have an even more profound impact than anticipated."

As time goes on, the benefits of Bitcoin - negligible fees, no personal information associated with transactions, decentralization (no central bank can devalue the currency by printing more and more of it), and the potential of the technology to have uses beyond mere payments, such as verifying ownership - will speed adoption and threaten many existing players.

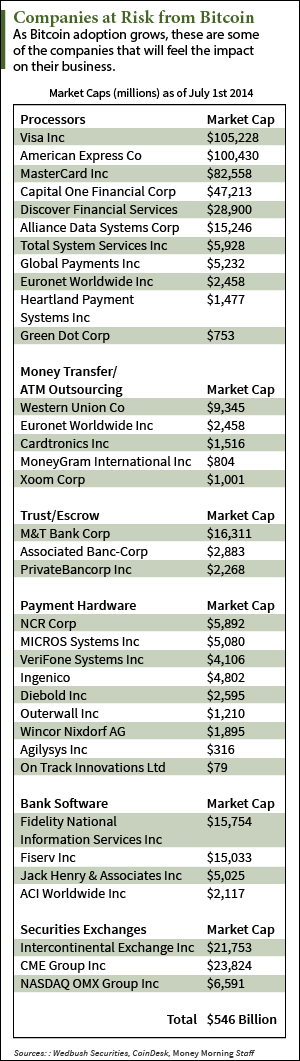

In its detailed "State of Bitcoin" report for the second quarter, Bitcoin news site CoinDesk names 34 companies with a combined market cap of $546 billion as susceptible to disruption by the growing adoption of Bitcoin.

Many of these companies are large and powerful, such as credit card giants Visa Inc. (NYSE: V) and Mastercard Inc. (NYSE: MA), money transfer company The Western Union Co. (NYSE: WU), payment hardware company NCR Corp. (NYSE: NCR), and securities exchange companies CME Group Inc. (Nasdaq: CME) and NASDAQ OMX Group, Inc. (Nasdaq: NDAQ).

Other financial sector categories at risk include payment processors, bank software, and trust/escrow.

Unless these Bitcoin market victims climb aboard the digital currency bandwagon soon, they risk getting run over by it.

Here's why they can't afford to wait much longer...

The World Won't Wait for the Bitcoin Market VictimsWhile Bitcoin is easy to ignore now, it is still in its earliest stages of adoption.

One other key takeaway from the CoinDesk report is that all of the primary metrics for measuring Bitcoin adoption are growing exponentially.

Bitcoin wallets, for example, increased from 765,039 in June 2013 to 5.33 million in June of this year - a sevenfold increase.

Venture capital investment over the previous 12 months rocketed from $17.1 million last June to $200.7 million this June - a twelvefold increase.

And the number of merchants accepting Bitcoin has doubled since mid-December to about 63,000 in June.

These numbers are small now, but it's the growth rates that matter. Within a few years, the Bitcoin ecosystem will reach critical mass, and for the Bitcoin stock victims who wait it will be too late.

"We believe the Bitcoin value proposition will become more apparent as applications currently in development come to market with longer-term concerns being quelled as the ecosystem matures," Luria said.

Surprisingly, many of the potential Bitcoin market victims have yet to view the digital currency as even a small threat. Most haven't even bothered to list Bitcoin as a risk in their U.S. Securities and Exchange Commission (SEC) filings.

They might want to reconsider, as an increasing number of experts are taking a more sober view of the impact Bitcoin is going to have in the years ahead.

"It remains to be seen how big a challenge Bitcoin poses to the system of national fiat currencies that has evolved since the 1970s," said noted economic historian Niall Ferguson, the Laurence A. Tisch Professor of History at Harvard University and a senior fellow at the Hoover Institution, in a recent article for The American Interest. "But it would be unwise to assume, as some do, that it poses no challenge at all."

Do you believe Bitcoin will disrupt the U.S. financial industry and these Bitcoin market victims in particular? And do you think these companies should do more to prepare for it? Let us know on Twitter @moneymorning or Facebook.

UP NEXT: When the U.S. Marshals Service auctioned off nearly 30,000 bitcoins last month, one venture capitalist, Tim Draper, bid high enough to get every one of them. That means he spent somewhere in the neighborhood of $18 million. Here's why he did it...

Related Articles:

- CoinDesk: State of Bitcoin Q2 2014 Report Reveals Expanding Bitcoin Economy

- Wedbush Securities: Timing and Sizing the Era of Bitcoin

- The American Interest: Networks and Hierarchies

The post How the Growing Bitcoin Market Will Cause a $3.4 Trillion Disruption appeared first on Money Morning - Only the News You Can Profit From.