Shanghai popped 2.5% this morning.

Shanghai popped 2.5% this morning.

The index flew back to it's highest level since Dec 16th as official Chinese data (ie questionable, at best) showed profits at China's largest Industrial Firms rose 17.9% in June from "just" 8.9% in May.

Despite the "stellar performance" of large-cap companies, the main reason the market is flying is because of a general consensus that Beijing may soon allow the banks to bring in more private of foreign strategic investors. Industrial and Commmercial Bank kicked the ball off by announcing a plan to raise $12.9Bn through the sale of preferred shares.

It's hard to reconcile this "good" news with the fact of the Baltic Dry Index (bulk shipping of raw materials) dropping back to 3-year lows in early July. Who then, is China selling to? Even the WSJ notes that major steel foundries like Tianjin have turned off their smelters – indicating a tremendous pullback in construction activity.

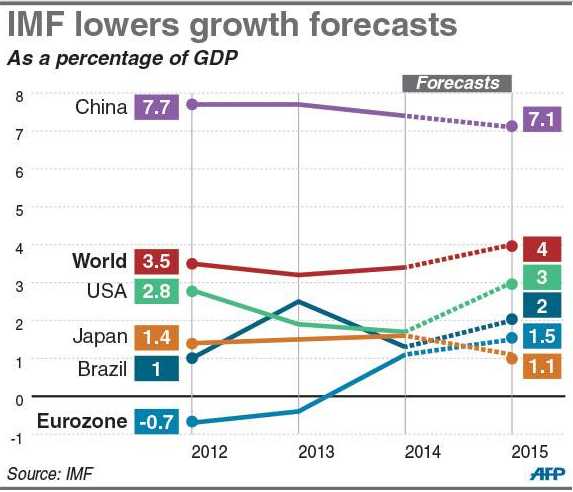

How is China achieving 7.5% growth if it is powering down steel plants and letting copper stockpiles build up? With debt. Despite official instructions to banks to curtail lending to overstretched developers and municipalities, loans are still increasing at rates twice as fast as the economy—and those numbers exclude a so-called shadow-banking lending system estimated at more than $5 trillion, or 80% of gross domestic product.

How is China achieving 7.5% growth if it is powering down steel plants and letting copper stockpiles build up? With debt. Despite official instructions to banks to curtail lending to overstretched developers and municipalities, loans are still increasing at rates twice as fast as the economy—and those numbers exclude a so-called shadow-banking lending system estimated at more than $5 trillion, or 80% of gross domestic product.

A big question is what happens to bad debts when the treadmill comes to a halt? Despite rhetoric about opening up the financial system to market pressures, there is clearly reluctance in Beijing to let lenders suffer losses. On Wednesday, for example, construction company Huatong Road & Bridge Co. somehow found the funds to make a bond payment that it had earlier warned it would miss.

Perhaps this is why the global reaction to the blazing Shanghai market is subdued at best. As you can see from the above chart, the Chinese market has been flying on this sort of "enthusiasm" since the start of Q2 but, as was made obvious last week, the other Global Markets are running out of steam. …

Perhaps this is why the global reaction to the blazing Shanghai market is subdued at best. As you can see from the above chart, the Chinese market has been flying on this sort of "enthusiasm" since the start of Q2 but, as was made obvious last week, the other Global Markets are running out of steam. …