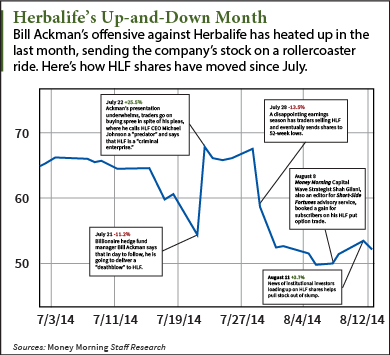

Bill Ackman's battle with Herbalife Ltd. (NYSE: HLF) has doomed the nutritional supplement maker's stock to bouts of wild volatility. In just the last month HLF stock has dropped 11.2%, surged ahead 25.5%, fell another 26.8%, and finally advanced another 5%.

Ackman triggered a buying spree last month when he claimed that he was going to deliver a "deathblow" to the company with a presentation on HLF's predatory business model.

While merely uttering "deathblow" plunged the stock into an 11.2% tailspin, the actual presentation on July 22 was underwhelming. The longs seemed to take the advantage back from the shorts as the stock soared 25.5% on the day.

After Ackman's July presentation, where he pledged to all but blow the lid off HLF's alleged pyramid scheme and predatory marketing practices, the company stock soared and was trading at $67.77 on the day.

Click to Enlarge |

This big loss came when HLF released its second-quarter earnings, revealing that the company fell short of analyst expectations for the first time since 2008.

Since then, HLF has traded back over $52, providing further evidence that this spat between activist investors going long and short sellers following Ackman's lead has had unpredictable consequences on the company's stock.

The most recent jab in this showdown was thrown by Capital Research and Management Co., an institutional investor that loaded up on more than 9 million shares of the diet shake vendor to take a 10.1% stake in the company on July 31. News of this large-scale share purchase at the beginning of the week helped push HLF stock above $50 after it breached a low last week post-earnings.

The best thing to come out of this volatility: Profit opportunities for savvy short sellers, like Money Morning's Capital Wave Strategist Shah Gilani, who bought puts on HLF in July... Gilani, who is also editor of the Short-Side Fortunes advisory service, got his subscribers a 91.84% gain when he sold half of the position on HLF stock in the midst of its dramatic price moves.

He sold the remaining half shortly after for a 53.06% gain. Gilani took the position after he noticed how fast the stock was moving during Ackman's "deathblow" presentation.

"In his face, as he was speaking, the stock shot up 25% to more than $67. That's crazy," Gilani said. "My thinking on the position was, first of all, it was crazy how the stock shot up on his speech about it going to $0, as in he was going to force Herbalife out of business. The chart said there was a good chance that another wicked downdraft could take it right back down to the low $50s."

Now a look at where this HLF stock battle began...

Herbalife's "Pyramid Scheme"The HLF battle has pitted one big-name investor against the other. On one end is Ackman of Pershing Square Capital Management LLC, with his short bet and heavy volume of put options, and on the other is Carl Icahn, who took a 16.8% stake in HLF to spite his Wall Street rival.

The debate has been over whether HLF runs a sound business model, or if its multi-level marketing is a Ponzi scheme waiting to be dismantled by the Federal Trade Commission.

Ackman first cried "pyramid scheme" on HLF's model in December 2012.

HLF does not operate like a standard health food wholesaler that supplies its products to individual retailers and nutrition stores. It instead relies on its network of more than 500,000 distributors in the United States and 3.9 million worldwide, known as "members," to act as the primary middlemen.

These members can sign up to act as distributors, after paying a small registration fee and signing an agreement, where they are able to buy HLF products at wholesale and sell them at retail prices for a profit.

They can also make commission by recruiting new members. Whenever a member's recruit purchases wholesale HLF products, the company cuts them a check for a percentage of their recruits' purchase.

But among Ackman's claims is that the wholesale purchase of HLF products is made expensive by an already overinflated price plus a whole host of other surcharges for delivery. In order to make a profit, members have to mark up these products for resale - so much so, it's cheaper for customers to just buy HLF products off eBay, instead of buying them from a distributor.

And because Ackman sees resale as an unprofitable venture, those who stick to the retail side of the business and forego recruiting constitute the bottom of the pyramid. They are losing money as they try to buy HLF products for resale, while the members who recruited them are making profits off these purchases whether they are sold outside of the HLF network or not.

According to Ackman's presentations, 93% of HLF distributors make no income, despite promises by the company that selling its products can provide a steady income.

Ackman has further alleged that in its filings, HLF fudged the books to blur the lines between actual sales to consumers who use the products, and the more predatory sales to low-level distributors. This would mean the products have little intrinsic value and no actual demand on the open market.

In December 2012, Ackman first announced that his firm would be taking out a $1 billion short bet on a company that he deemed valueless.

The nutrition vendor has fired back. Just after the July presentation where Ackman expanded on his attacks, HLF released a statement that vouched for the quality of its products.

According to the release, 80% of their product volume is consumed by those either outside of the HLF distributor network or those in the network taking advantage of wholesale prices for their own consumption.

Ackman's attack attracted the likes of Icahn, another celebrity investor, to take the other side of the trade.

Along with Icahn's 16.8% stake, Ackman is up against Fidelity Management and Research Company, which holds more than 11 million shares and has an 11.2% claim, Capital Research's 10.1%, Capital World Investors' 7.4%, and celebrity investor George Soros' 4.8%, according to data from Morningstar.

The Herbalife battle has a storied history dating back to the company's founding in 1980. Read here about the company's frequent run-ins with government regulators, the sudden death of an eccentric CEO, and the roots of the Wall Street showdown that has touched off a struggle between short sellers and long buyers...

Tags: activist investors, Bill Ackman, Carl Icahn, HLF, HLF short, HLF stock, NYSE: HLF, short selling, shorting HLFThe post Herbalife (NYSE: HLF) Stock on Wild Ride Thanks to Ongoing Long-Short Battle appeared first on Money Morning - Only the News You Can Profit From.