( click to enlarge )

( click to enlarge )Neurometrix Inc (NASDAQ:NURO) closed on Thursday at 1.85, advancing 8.8% with relatively high volumes. This stock shows clear signs of bottoming-out, gaining +15% in the last five sessions. The bullish MACD crossover and the candlestick pattern on daily charts suggest higher probability for a break out for the stock at 2.11 (EMA200) to show further up side in the near term. I think investors are buying ahead of news for NC-stat DPNCheck in China. NC-stat DPNCheck is a rapid, accurate and quantitative point-of-care test for early detection of diabetic peripheral neuropathy, which affects over half of people with diabetes. I still holding my long position. I believe this stock has a potential to hit 4 or more by end of this year. Stop 1.44

( click to enlarge )

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) is getting ready to come out of a nice basing pattern. Trajectories of some key indicators suggest high probability for an immediate sharp up move for the stock. A close above $9.60 gets the party started.

( click to enlarge )

( click to enlarge )Twitter Inc (NYSE:TWTR) closed Thursday's trading session at 45.33 inching up by 2.67 per cent with relatively solid volumes of 23 million shares traded. The stock price demonstrates positive outlook by managing to stay above all major EMAs, supported by the positive momentum indicators on daily charts. On the up side, the immediate resistance is likely for the stock at 46.12.

( click to enlarge )

( click to enlarge )J C Penney Company Inc (NYSE:JCP) potential breakout play today.

( click to enlarge )

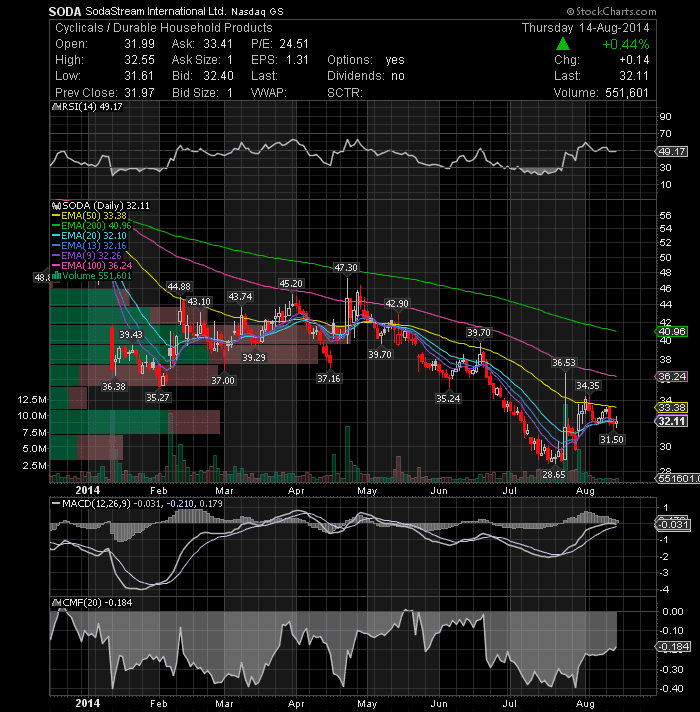

( click to enlarge )Sodastream International Ltd (NASDAQ:SODA) If we reclaim the EMA50 and hold, i expect a rapid move toward 36 area. The outlook continues to be positive for the stock as it manages to stay above the 31 level supported by positive moves of momentum indicators. Worth keeping an eye on.

( click to enlarge )

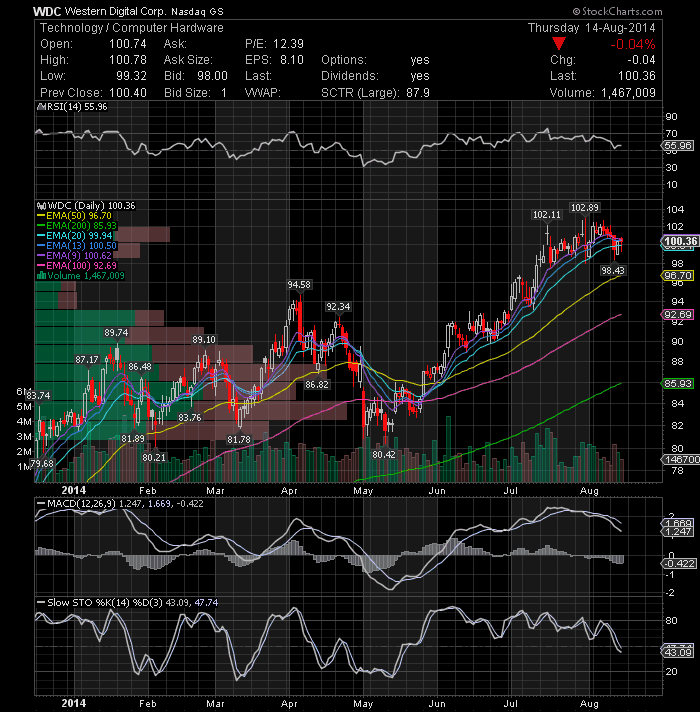

( click to enlarge )Western Digital Corp (NASDAQ:WDC) closed the previous trading session at 100.36. The stock price demonstrates weakness by slipping below short-term EMAs on daily charts, supported by the trajectories of the momentum indicators. The stock price is likely to test immediate support at 96.70

( click to enlarge )

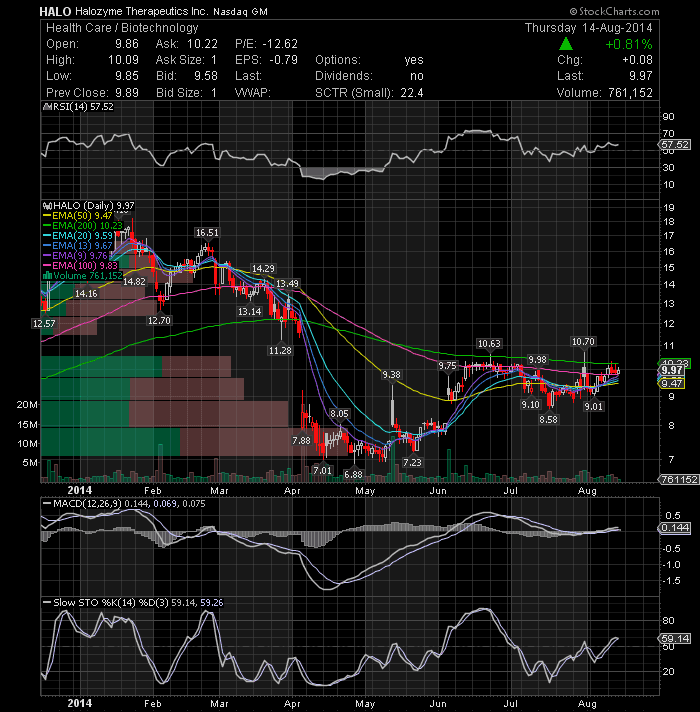

( click to enlarge )Halozyme Therapeutics, Inc. (NASDAQ:HALO) Looks like it is getting ready for a breakout soon. A high volume move through the 10.23 price level would be buyable.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC