Gold price forecast, Aug. 29, 2014: Buying gold during the late days of summer has proved to be a winning trade for most of the last two decades, according to Bloomberg.

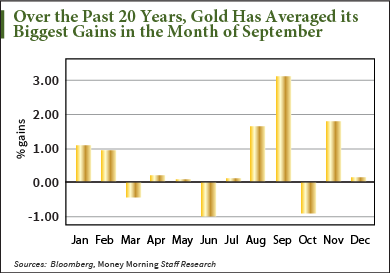

Indeed, September is historically gold's best month. Over the last 20 years, the yellow metal has seen an average gain of 3% in September.

Indeed, September is historically gold's best month. Over the last 20 years, the yellow metal has seen an average gain of 3% in September.

What's more, September's traditional gains have trounced the next best month, November, when the gold price has logged an average 1.8% gain over the last 20 years.

Our gold price forecast that follows shows why September is so good for gold...

Gold Price Forecast: India's Insatiable Appetite for GoldGold buying picks up to a near-frenzied pace in India in late August through October, as the country celebrates the Hindu festival Vinayaka Chaturthi (also known as Ganesh Chaturthi).

"Demand is picking up every day," Rahul Gupta, managing director of P.P. Jewellers, a large Indian jewelry chain, told The Wall Street Journal. "Festival season sales have started."

Celebrations began Aug. 29, when Indians celebrate the birthday of Lord Ganesh, the god of intellect and wisdom who is identified by his elephant head. Yellow metal sales in India rise during this time because it's deemed good luck to buy gold ornaments for the festivities.

During Diwali, the five-day Hindu festival of lights that is celebrated starting Oct. 23, people usually invest in gold coins and bars. The spiritual festival signifies the victory of light over darkness, knowledge over ignorance, good over evil, and hope over despair. Gold jewelry sales tend to enjoy a sharp spike during Diwali - and price gains usually start early.

"Indian jewelers and dealers will be stocking up in the coming weeks, so it should affect prices," Mark O'Byrne, a director at brokerage GoldCore Ltd. in Dublin, told Bloomberg. "A lot of traders are aware of this trend towards seasonal strength, so that may contribute to higher prices. They tend to buy and that creates momentum."

Next comes the nation's wedding season, when bullion is bought for bridal trousseaus, as well as jewelry, shiny gold bars, and coins to be presented as gifts.

One reason festival demand should remain high this year is that the country's monsoon season was not as bad as feared. The majority of India's gold demand comes from rural areas, so the monsoon weighs heavily on purchases.

In addition to robust demand in India, gold purchases are likely to increase in another major market as we head into the end of the year...

Gold Price Forecast: China's Lunar New Year Gold ObsessionDemand for gold in China will likely surge ahead of the country's lunar New Year, Wallace Ng, a senior precious metals trader based in Beijing, told The Journal.

That because China's lunar New Year celebration in February marks an auspicious time to buy gold.

Yellow metal purchases are expected to increase ahead of the Asian nation's Year of the Sheep celebration, which begins on Feb. 19 and lasts for 15 days. Celebrations, however, typically start as much as three weeks before, and gold purchases begin even months before.

Last year, amid gold's 28% swoon, it biggest decline in 32 years, Chinese consumers took advantage of the slump.

Gold purchases by bargain-hunting Chinese consumers jumped 41% in 2013 to a record 1,066 tons, according to the China Gold Association.

The increase was enough for China to overtake India, which for decades held the No. 1 spot, as the world's largest gold consumer nation.

China has long had a cultural affinity for precious metals. The growing affluence of consumers there, coupled with more relaxed investment restrictions, has boosted the Asian nation's demand for gold bars, coins, and jewelry.

Next: A confluence of factors makes today's silver prices look downright cheap - but make no mistake, a silver bull market is coming. Here's how to invest in silver today for double-digit gains...

Related Articles:

- International Business Times: India Budget 2014: Government Leaves Gold Import Tax Unchanged

- Wall Street Journal: India's Appetite for Gold Improves

The post Gold Price Forecast for September Shows Demand – and Prices – Surging appeared first on Money Morning - Only the News You Can Profit From.