( click to enlarge )

( click to enlarge )Very bullish action on GoPro Inc (NASDAQ:GPRO) last week. The stock firmed around 69.75-71 and then broke out with three days of high volume. If prices pullback, the $76.48 (20EMA) level is a possible area for them to be supported at. All technical indicators still point to a bull market. The chart above (2h) shows the stock price is in a very strong upward momentum as both 50-day and 200-day exponential moving averages are going up along with the stock. The MACD and RSI also shows the stock is currently in a bull market. For now, the trend is still up.

( click to enlarge )

( click to enlarge )Alibaba Group Holding Ltd (NYSE:BABA) On Friday, the stock broke out of the 88.50-90 range in which it has been trading within for the past few sessions. If the stock next week crosses the swing high of the past week 91.50 on the upside, then the uptrend will be confirmed and traders can inititate fresh longs with a stop loss located at 88.48.

( click to enlarge )

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) moved up strongly after earnings report on Friday as the company beat the Wall Street's estimates. I would like to point out that the BlackBerry Messenger witnessed a huge rise in the number of users. This service has now more than 91 million monthly active users, which is a gain of 6% from a quarter ago and 44% by the way over a year ago. If you remember, Facebook paid 19 billion for Whatsapp and in my opinion BBM is better than whatsapp, because the messages are encrypted, offering you privacy and security. From a technical standpoint, this reversal seems especially likely to continue. Going ahead a move above Friday's high of 10.65 will be the next trigger for the stock. A sustainable move above this level might result in an upside target of 11.17 in the coming week. On the downside, 10 and 9.70 levels might act as a support for the stock.

( click to enlarge )

( click to enlarge )Liquid Holdings Group Inc (NASDAQ:LIQD) is currently attacking the upper line of the falling wedge pattern and could be ready to breakout after strong volume on Friday. A successful cross of the resistance line the stock can rally up to the next resistance level which is at 1.60 levels.

( click to enlarge )

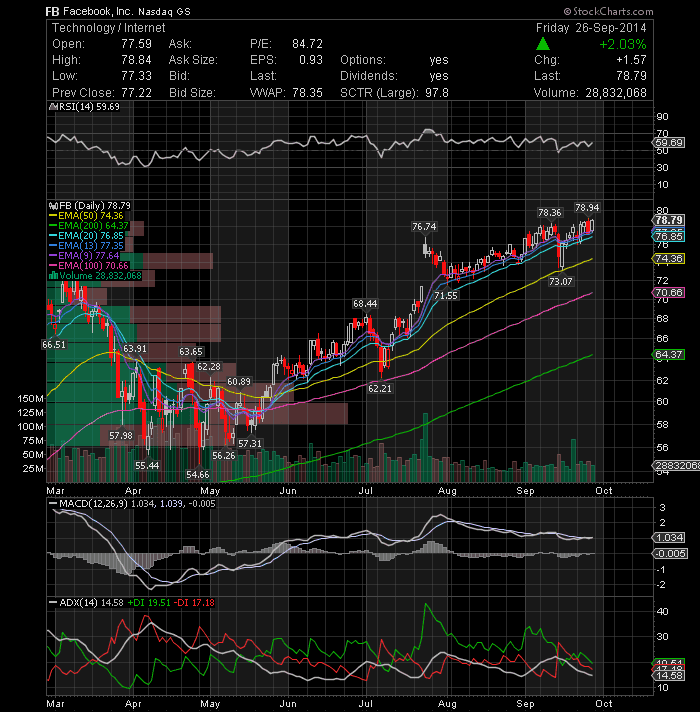

( click to enlarge )Facebook Inc (NASDAQ:FB) is doing relatively well considering the market's condition and a break above 79 on heavy volume would be bullish.

( click to enlarge )

( click to enlarge )Amazon (NASDAQ:AMZN) A possible head and shoulders setting up ? If the stock closes below the 320 support area, then it might fall towards the next support level at 300. Any further losses could take the stock towards the 280 level. The mentioned possible head and shoulders pattern would invalidate if the stock jumps above the 335 level. The MACD indicator continues to drift lower, confirming sustained downside strength.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC