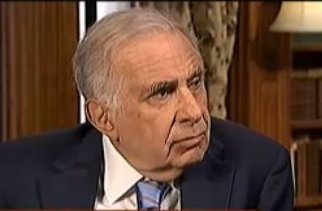

It's one thing to be optimistic about a stock, but activist investor Carl Icahn's letter to Apple Inc. (Nasdaq: AAPL) Chief Executive Officer Tim Cook tries to make the case that Apple stock is worth double its current price today.

The letter, released today (Thursday) following a teaser tweet the night before, is Icahn's second push to get Apple to use a major portion of its $133 billion in cash for stock buybacks.

The previous campaign started in the summer of 2013 and ended in February with Icahn losing a proxy fight. Icahn lost that battle but won the war, as Apple ended up implementing the stock buybacks and dividend increases that Icahn wanted, though in smaller amounts.

The previous campaign started in the summer of 2013 and ended in February with Icahn losing a proxy fight. Icahn lost that battle but won the war, as Apple ended up implementing the stock buybacks and dividend increases that Icahn wanted, though in smaller amounts.

As part of his new push, Icahn says AAPL stock is actually worth $203 a share, and so any buyback would be a bargain.

An AAPL stock price of $203 would put the Cupertino, Calif., company's market cap just under $1.2 trillion, an amazing figure that would make Apple worth 6% of the Standard & Poor's 500.

To be sure, Apple stock has the potential to go a lot higher over the next few years. We think it has a good shot at hitting $167 a share for a $1 trillion valuation - but not until 2018 at the earliest, and even then only if Cook keeps his foot on the accelerator.

Even the most optimistic one-year price target among the analysts that follow AAPL is $139 a share.

Icahn must know how far-fetched his valuation is, so why put it out there?

Make no mistake, Icahn's ultimate goal is to walk away from AAPL with wheelbarrows of cash.

He's just tweaking his playbook this time...

What Carl Icahn Wants His Letter to Apple to AchieveTypically, Icahn aggressively criticizes the leadership of the company - the CEO and his executive team, and often the board as well.

This letter is almost the anti-Icahn. It offers no criticism or advice. Instead, Icahn goes out of his way to heap praise on Cook and his team. It's almost fawning in some places.

As for the usual push for a specific action, such as dividend increases, stock buybacks, or spin-offs, we get only a call for still more stock buybacks.

More stock buybacks at this stage won't do much for the Apple stock price, and Icahn knows it.

No, the real point of the Carl Icahn letter to Tim Cook is to use the Icahn star power to promote the idea that AAPL stock is severely undervalued in the most visible way possible.

Look at how he handled this...

First, there was the teaser tweet to get everyone's attention.

Then the novella of a letter - it's more than 4,200 words - that offers a detailed, rose-colored analysis of current, future, and imagined Apple products that justify the $203 price.

Not only is the analysis wildly optimistic, it even includes a phantom product - an Ultra high definition television that may never see the light of day.

And just in case anyone missed the letter, Icahn appeared on several financial news cable channels today to hammer home why Apple stock is going to the moon.

I don't doubt that Icahn believes that Apple is a strong company with great prospects and that the stock arguably should be higher than it is. We agree.

But the reason Icahn is suddenly everywhere talking about a buyback is not to get a buyback. It's to convince as many investors as possible that AAPL stock is a screaming buy right now, which inevitably will drive the Apple stock price higher.

Remember that Icahn, who owns some 53 million shares of AAPL, grows $53 million richer with every $1 increase in the Apple stock price.

Apple doesn't need to get anywhere near $203 for Icahn to score huge profits. But more people are likely to buy AAPL when Icahn says it's really worth $203 than if he says it's really worth $125. Who doesn't want to miss out on an opportunity to double their money?

It's a clever strategy from the guy who pretty much invented activist investing.

Follow me on Twitter @DavidGZeiler.

UP NEXT: Most of Apple's success today is directly attributable to late CEO Steve Jobs. But that doesn't mean every choice he made was the right one. Here are nine of the iconic leader's biggest blunders...

Tags: AAPL, AAPL Stock, AAPL Stock Price, activist investing, activist investments, Apple stock, apple stock price, Carl Icahn, Carl Icahn letter to Apple, Nasdaq: AAPL, tech investing, tech stocksThe post This New Apple Stock Strategy Is a Tweak to the Carl Icahn Playbook appeared first on Money Morning - Only the News You Can Profit From.