( click to enlarge )

( click to enlarge )MagneGas Corporation (NASDAQ:MNGA) starts showing buy signals again. The stock looks poised to break a downtrend line on the daily chart established in June. Technical indicators are forming bullish patterns. The MACD has just managed to enter positive zone, forming a rounding bottom pattern. Both Slow stochastic and RSI stochastic are above their respective 50% levels and the ADX is showing a sign of strength as it's starting to turn upwards. If the stock confirms the breakout by breaking above $1.35 resistance the initial price target would be at $1.83

( click to enlarge )

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) closed back above its 200-day exp moving average for the first time in two weeks and the price broke out of the descending channel, a strong bullish indicator. At this point, it seems that we have room for $1.5 run before next resistance at $11.17. The MACD is about to cross above its signal line. Bulls are likely to resume their dominance.

( click to enlarge )

( click to enlarge )Anacor Pharmaceuticals Inc (NASDAQ:ANAC) has been in a steady uptrend for the last five months. The stock is in a good Bullish moment with all indicators showing strength to move up. So, it will not be a surprise for me if stock breaks above $26 next week.

( click to enlarge )

( click to enlarge )The technical chart of Facebook Inc (NASDAQ:FB) is now much improved after Friday’s action. The MACD is reversing course and stock finally closed above all EMAs again, usually this is a Bullish signal. I would look for a move up to $78 resistance soon. If it passes that, then we have room to run to next resistance at $79.71.

( click to enlarge )

( click to enlarge )Navidea Biopharmaceuticals Inc (NYSEMKT:NAVB) is approaching again the $1.45 level, which typically acts as resistance, so keep an eye on it for a possible breakout.

( click to enlarge )

( click to enlarge )Digital Ally, Inc. (NASDAQ:DGLY) is a stock to watch closely next week. It has a big resistance range at $13.4-$13.76, which is where we need it to break to make a big move. Keep an eye on it for a possible breakout.

( click to enlarge )

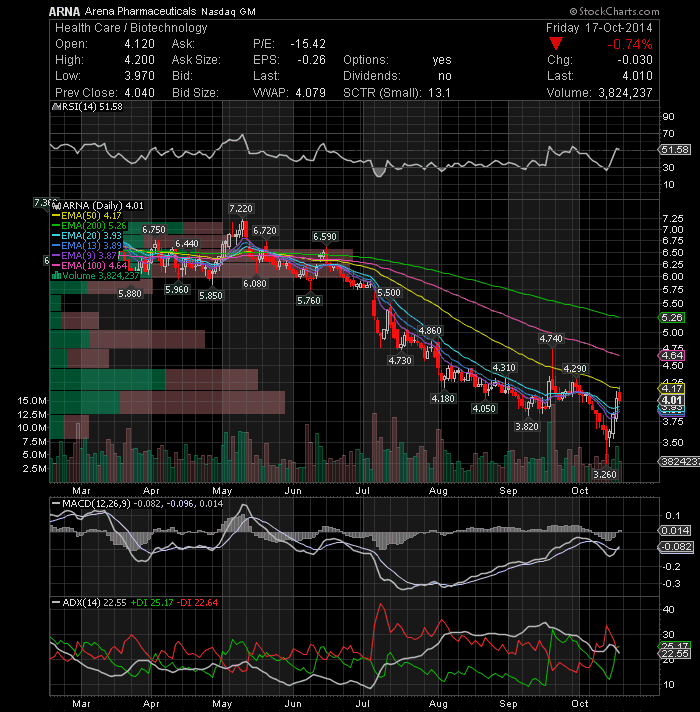

( click to enlarge )Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) is testing the 50-day EMA resistance line but did not get through. If market attempts a rally, a possible breakout over $4.17 is very likely. Wait for a close above this mark to enter long.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC