It seems we weathered that storm very well! As noted in our the last review of our virtual portfolios , BALANCE is the key to riding the market waves and we not only survived recent the 10% drop and 7% pop but we have thrived – with our Short-Term Porfolio holding onto a $94.2% gain (as of yesterday's close) and the Long-Term Portfolio back to 19.2% for the year, for a combined $790,353 off our $600,000 start – a combined 31.7% gain for the year! I would say it's time to cash out but we've already cashed out with the Short-Term Portfolio now sitting on $179,243 in cash (92%) and the LTP has $637,800 in cash, which is 107% of the portfolio's value. That's because we've sold so much premium to others (our " Be the House " strategy) that it dwarfs the net value of our positions. Nonetheless, we're only using 34% of our $1M margin as these are, generally, conservative long-term positions. We went into the weekend leaning very bearish in the STP, protecting our long gains in the LTP and Income Portfolios. CAKE – Was a disappointment as they lowered guidance on earnings on 6.3% more revenues and they lowered guidance to $2.07 from $2.25 – flat to last year. Our mistake here was looking at the costs of food products like corn, wheat, etc for basic foodmaking but it was the cost of cream cheese that killed them on the food side. Last year they topped out in the high $40s and now we are in the low $40s and I'm willing to go long on them but not appropriate for the STP – we'll look to cut this one loose next week. GMCR – Getting to be a white whale for us, the damned thing never goes down. Earnings are 11/19 – I certainly want to see those. FAS – Part of the other FAS Money Spread below (there's a limit of 4 legs to one spread). While this spread can be very stressful to manage, it's responsible for 10% of our profits this year. SQQQ – Our primary hedge, though taking a huge hit …

It seems we weathered that storm very well!

It seems we weathered that storm very well!

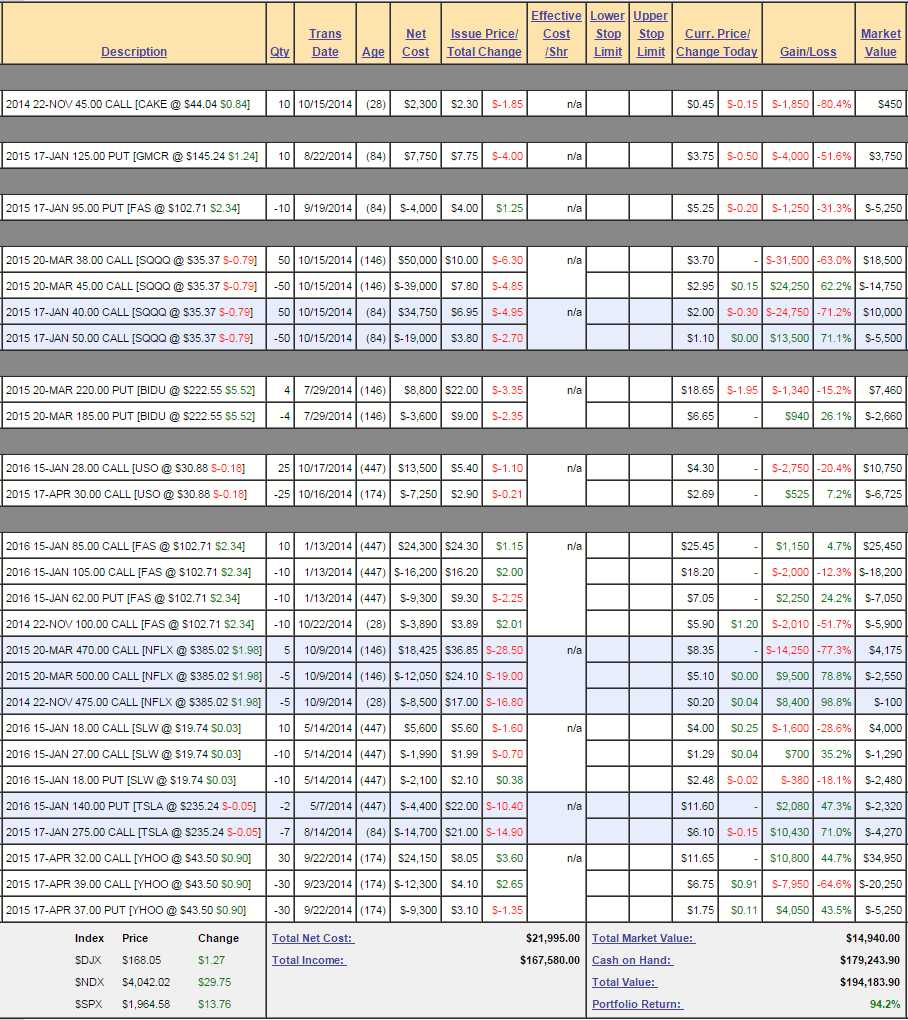

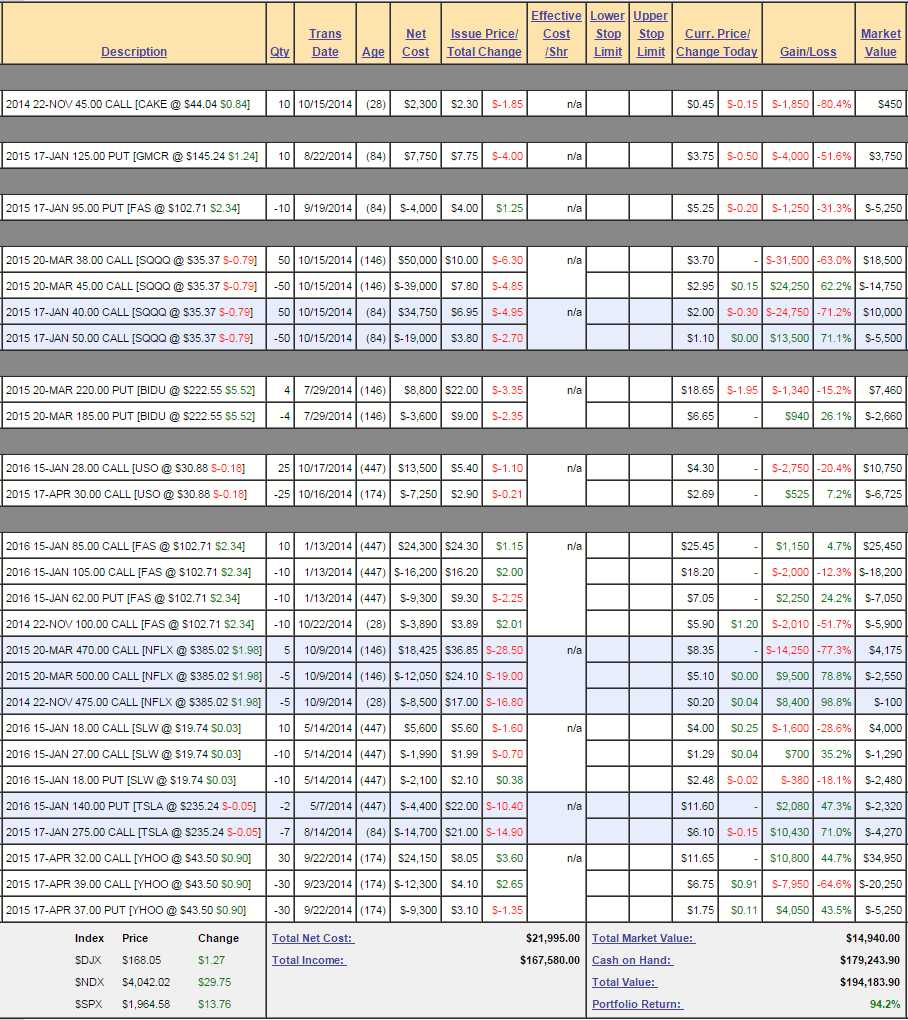

As noted in our the last review of our virtual portfolios, BALANCE is the key to riding the market waves and we not only survived recent the 10% drop and 7% pop but we have thrived – with our Short-Term Porfolio holding onto a $94.2% gain (as of yesterday's close) and the Long-Term Portfolio back to 19.2% for the year, for a combined $790,353 off our $600,000 start – a combined 31.7% gain for the year!

I would say it's time to cash out but we've already cashed out with the Short-Term Portfolio now sitting on $179,243 in cash (92%) and the LTP has $637,800 in cash, which is 107% of the portfolio's value. That's because we've sold so much premium to others (our "Be the House" strategy) that it dwarfs the net value of our positions.

Nonetheless, we're only using 34% of our $1M margin as these are, generally, conservative long-term positions. We went into the weekend leaning very bearish in the STP, protecting our long gains in the LTP and Income Portfolios.

- CAKE – Was a disappointment as they lowered guidance on earnings on 6.3% more revenues and they lowered guidance to $2.07 from $2.25 – flat to last year. Our mistake here was looking at the costs of food products like corn, wheat, etc for basic foodmaking but it was the cost of cream cheese that killed them on the food side. Last year they topped out in the high $40s and now we are in the low $40s and I'm willing to go long on them but not appropriate for the STP – we'll look to cut this one loose next week.

- GMCR – Getting to be a white whale for us, the damned thing never goes down. Earnings are 11/19 – I certainly want to see those.

- FAS – Part of the other FAS Money Spread below (there's a limit of 4 legs to one spread). While this spread can be very stressful to manage, it's responsible for 10% of our profits this year.

- SQQQ – Our primary hedge, though taking a huge hit

…

It seems we weathered that storm very well!

It seems we weathered that storm very well!