Will bad news be good news? We're waiting on the revised Q4 GDP Report and the data we've been seeing does not bode well for the revision we'll get at 8:30 this morning and, currently, the expectations are for 2.4% growth – less than that will signal a weaker economy but that then may give investors the impression the Fed will maintain an easy monetary stance later into the year. Meanwhile, as you can see from Dave Fry's SPY chart, we've already completed the first part of the " Golden Arches " pattern that we predicted back on the 19th ( while everyone else was in bull mode ) and it would be a good bullish sign still (now that everyone is bearish) if SPY manages to hold the 200 dma at 204.50 – so there's going to be a lot riding on the GDP report AND people's reaction to it this morning. Yesterday we charted out the 5% Rule™ for our Members (and we reviewed the charts in yesterday's Live Trading Webinar) and our bounce lines were at: Dow 17,720 (weak) and 17,850 (strong) S&P 2,055 (weak) and 2,060 (strong) Nasdaq 4,865 (weak) and 4,905 (strong) NYSE 10,880 (weak) and 10,910 (strong) Russell 1,235 (weak) and 1,245 (strong) We made that call at 10:19, when the Dow was at 17,612, S&P 2,048, Nasdaq 4,828, NYSE 10,854 and Russell 1,226 and, in the end, we were off by a grand total of 63 points on 5 indexes that total 36,694 points so we missed it by 0.17% – not bad! Even better if you were a Member ( sign up here ) who got our Morning Report delivered to your In Box pre-markets, as we said right at the bottom of the post : We have already hit our primary goal at 2,035 (the 10% line on our Big Chart) on the S&P Futures (/ES) and we flipped long there in our Live Member Chat as well as long on /TF (Russell Futures) at 1,220 and short on oil at $52 (/CL) to lock in our bonus gains for the morning and take advantage of the bounce (probably weak). We…

Will bad news be good news?

Will bad news be good news?

We're waiting on the revised Q4 GDP Report and the data we've been seeing does not bode well for the revision we'll get at 8:30 this morning and, currently, the expectations are for 2.4% growth – less than that will signal a weaker economy but that then may give investors the impression the Fed will maintain an easy monetary stance later into the year.

Meanwhile, as you can see from Dave Fry's SPY chart, we've already completed the first part of the "Golden Arches" pattern that we predicted back on the 19th (while everyone else was in bull mode) and it would be a good bullish sign still (now that everyone is bearish) if SPY manages to hold the 200 dma at 204.50 – so there's going to be a lot riding on the GDP report AND people's reaction to it this morning.

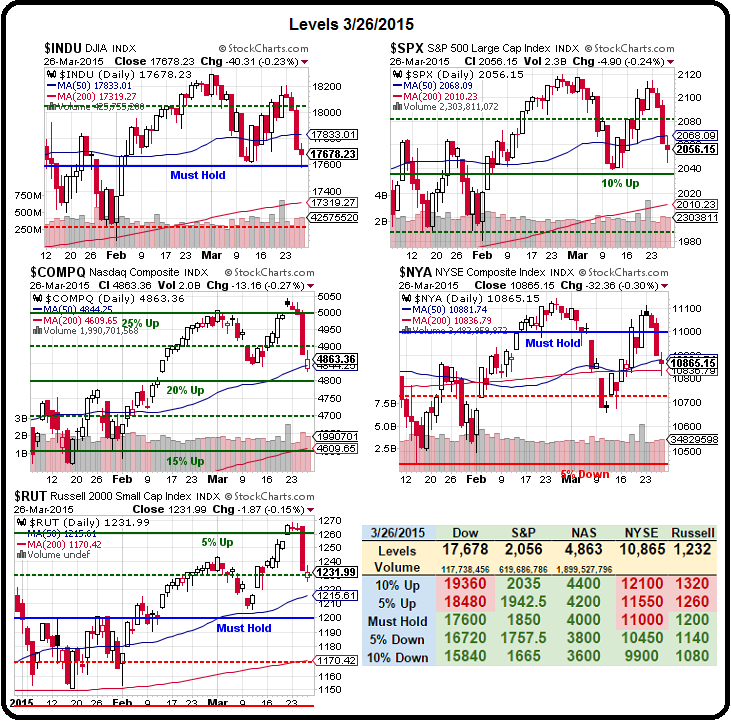

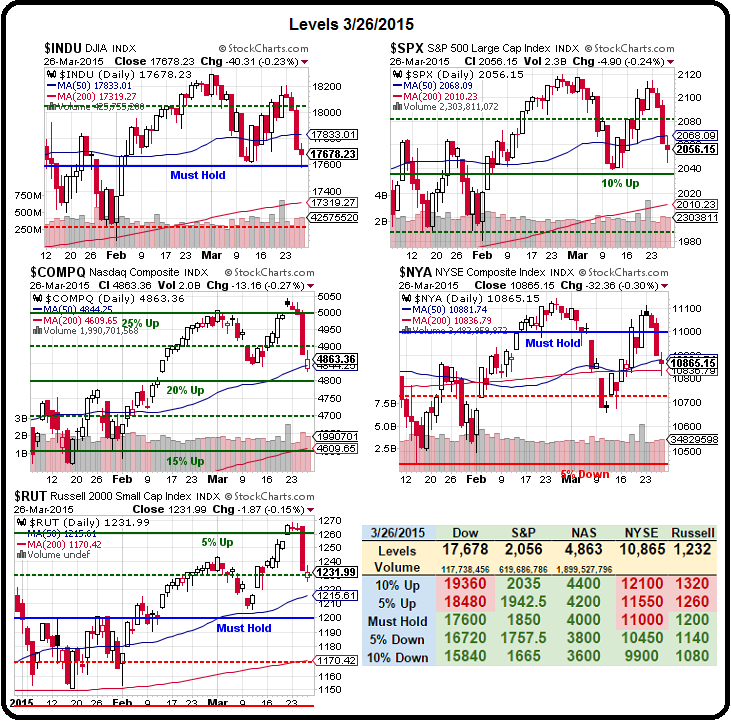

Yesterday we charted out the 5% Rule™ for our Members (and we reviewed the charts in yesterday's Live Trading Webinar) and our bounce lines were at:

Yesterday we charted out the 5% Rule™ for our Members (and we reviewed the charts in yesterday's Live Trading Webinar) and our bounce lines were at:

- Dow 17,720 (weak) and 17,850 (strong)

- S&P 2,055 (weak) and 2,060 (strong)

- Nasdaq 4,865 (weak) and 4,905 (strong)

- NYSE 10,880 (weak) and 10,910 (strong)

- Russell 1,235 (weak) and 1,245 (strong)

We made that call at 10:19, when the Dow was at 17,612, S&P 2,048, Nasdaq 4,828, NYSE 10,854 and Russell 1,226 and, in the end, we were off by a grand total of 63 points on 5 indexes that total 36,694 points so we missed it by 0.17% – not bad! Even better if you were a Member (sign up here) who got our Morning Report delivered to your In Box pre-markets, as we said right at the bottom of the post:

We have already hit our primary goal at 2,035 (the 10% line on our Big Chart) on the S&P Futures (/ES) and we flipped long there in our Live Member Chat as well as long on /TF (Russell Futures) at 1,220 and short on oil at $52 (/CL) to lock in our bonus gains for the morning and take advantage of the bounce (probably weak).

We…

Will bad news be good news?

Will bad news be good news?  Yesterday we charted out the 5% Rule™ for our Members (and we reviewed the charts in yesterday's Live Trading Webinar) and our bounce lines were at:

Yesterday we charted out the 5% Rule™ for our Members (and we reviewed the charts in yesterday's Live Trading Webinar) and our bounce lines were at: