Bad news is great news!

Bad news is great news!

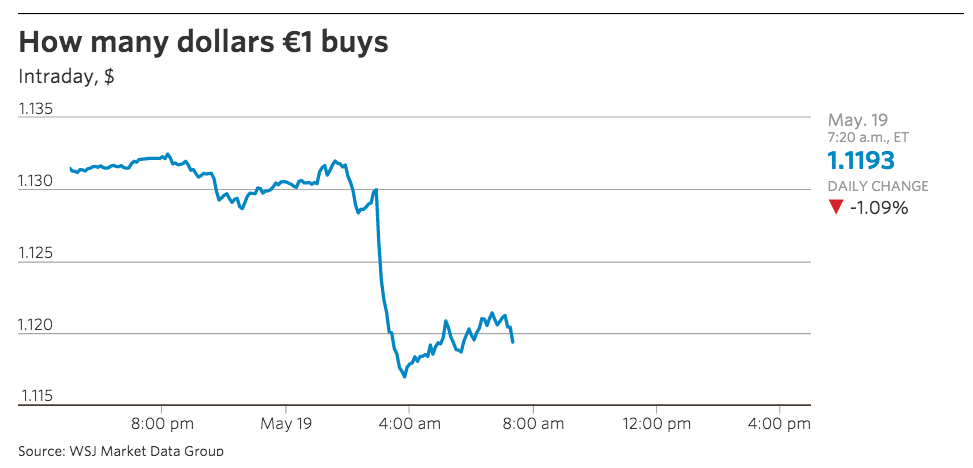

The Greek talks have stalled, England's CPI is deflating, German GDP slipped to 0.3% in Q1 and German Investor Sentiment (ZEW) dove to a 5-month low, dropping over 20% in one month to 41.9. That and collapsing bond prices were the last straw for the ECB, who announced this morning they would "front-load" their $75Bn monthly bond-buying into May and June, to avoid having to bother over the holidays.

This is a fun way the ECB can double up on stimulus without SAYING they are doubling up on stimulus:

“Even though this is just front-loading, it is effectively an increase in the size of quantitative easing, even if just for a short period of time,” saidSimon Derrick, a currency strategist at BNY Mellon. “It shows that within the existing framework, the ECB is willing and able to be incredibly flexible,” Mr. Derrick said.

Separately on Tuesday, Christian Noyer, the head of France’s central bank and a member of the ECB governing council, said the ECB was ready to go further if needed to meet its inflation target. “The purchase program will continue until the end of September 2016 and beyond if we do not see a sustained adjustment in the path of inflation,” he said.

Separately on Tuesday, Christian Noyer, the head of France’s central bank and a member of the ECB governing council, said the ECB was ready to go further if needed to meet its inflation target. “The purchase program will continue until the end of September 2016 and beyond if we do not see a sustained adjustment in the path of inflation,” he said.

Does anyone besides me think it's strange to announce more QE WHILE the markets are making record highs? Anyone???

We have indeed fully embraced the worst kind of Voodoo Economics, with the World's Central Banks creating endless supplies of money out of thin air by simply writing checks to buy bonds which enable the Sovereign nations to go endlessly into debt. There have been, so far, no consequences for this behavior and even countries like Greece, who have no possibility whatsoever of being able to pay off their debts, are lent more and more money.

We have indeed fully embraced the worst kind of Voodoo Economics, with the World's Central Banks creating endless supplies of money out of thin air by simply writing checks to buy bonds which enable the Sovereign nations to go endlessly into debt. There have been, so far, no consequences for this behavior and even countries like Greece, who have no possibility whatsoever of being able to pay off their debts, are lent more and more money.

As you can see from the chart, househld debt and Government debt have climbed substantially…