Another weak export report. No mention of the drop in oil prices reduced foreign incomes.

LA area Port Traffic: Weakness in June

by Bill McBride on 7/20/2015 09:57:00 AM

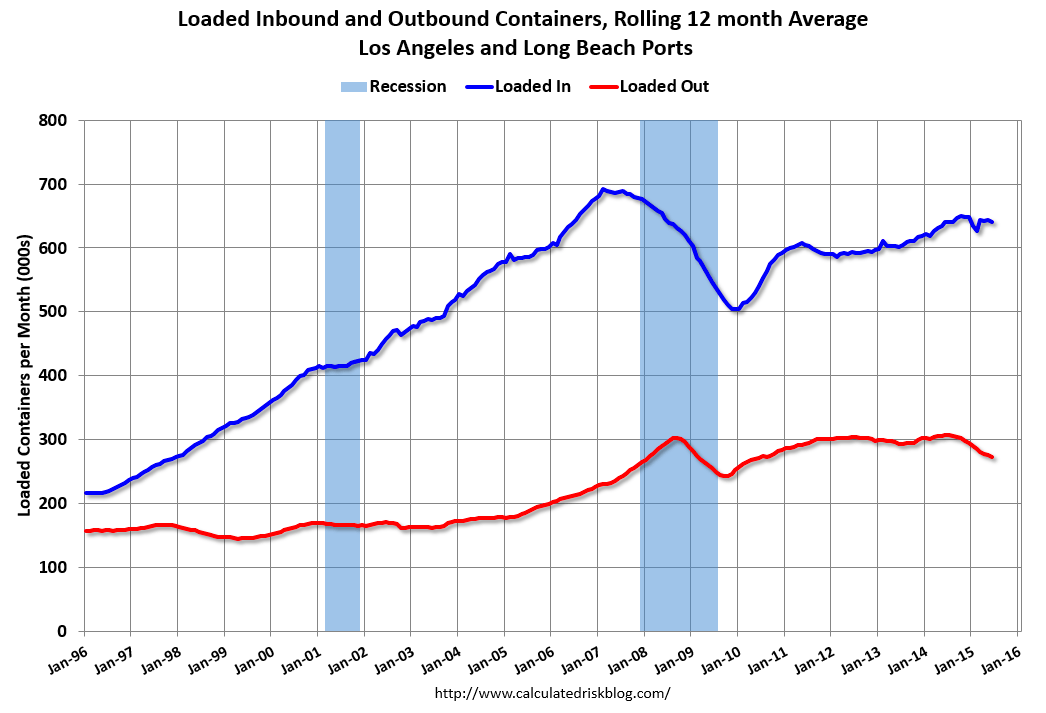

Note: There were some large swings in LA area port traffic earlier this year due to labor issues that were settled on February 21st. Port traffic surged in March as the waiting ships were unloaded (the trade deficit increased in March too), and port traffic declined in April. Perhaps traffic in June is closer to normal.

Container traffic gives us an idea about the volume of goods being exported and imported – and usually some hints about the trade report since LA area ports handle about 40% of the nation’s container port traffic.

The following graphs are for inbound and outbound traffic at the ports ofLos Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.4% compared to the rolling 12 months ending in May. Outbound traffic was down 0.9% compared to 12 months ending in May.

The recent downturn in exports might be due to the strong dollar and weakness in China.

Read more at Calculated Risk Blog

Reads like they still don’t have a clue about how banking works:

The Greek government ordered banks to open on Monday, three weeks after they were shut down to prevent the system collapsing under a flood of withdrawals,

***That doesn’t cause collapse. Depositors might have to wait for their Euro. That’s all. No reason for the govt. to close the banks. Reads to me like the govt. thinks that Euro needed to run the economy, pay taxes, etc. would leave the country, or something like that. Makes no sense.

As Prime Minister Alexis Tsipras looked to the start of new bailout talks next week.

The first action of the new cabinet was to sign off on a decree to reopen banks on Monday with slightly more flexible withdrawal limits that allow a maximum of 420 euros a week in place of the strict limit of 60 euros a day currently in place.

But restrictions on transfers abroad and other capital controls remain in place.

***It’s up to the banks to set their limits based on how much liquidity they have available.

Also:

Three week shutdown of Greece banks cost the economy an estimated €3B, not counting lost tourism revenue – press – Athens Chamber of Commerce and Industry (EBEA) says some 4,500 containers with raw materials and finished products are blocked at customs.

Additionally, €6B in business transactions were frozen by the bank shutdown.- Retailers lost about €600M in business, with apparel taking the main blow. Exporters lost €240M.

Source: TradeTheNews.com

Yes, negative growth and recession sometimes happens without a domestic financial

crisis, and without any financial crisis globally as well.

Lots of things can cause deficit spending- both non government (private sector) and government together- from being insufficient to offset agents desiring to spend less than their incomes.

Sometimes it’s a sudden obstruction to lending and sometimes it’s not.

Sometimes the agents spending more than their incomes just fade away. For a government allowing the deficit to get too small is a political choice, sometimes well informed but most often misguided.

For the private sector it could be insufficient income, or any reason it simply doesn’t want to borrow to spend or spend from savings.

And the private sector tends to be pro cyclical. That is, should GDP growth decline, private sector borrowing to spend tends to taper as well, as credit worthiness deteriorates, causing the slowdown to get worse. This downward process continues until some agent starts spending more than its income, which historically is government, as tax revenues fall and transfer payments increase with rising unemployment from the downward spiral.

So looks to me like it was the oil capex that was keeping up with the demand leakages, and when that collapsed as prices fell the demand leakages got the upper hand. And so far no sign of anything else stepping up its spending enough to move the GDP needle.

The post LA Port Traffic, Greek Banks, Recession Without Financial Crisis appeared first on The Center of the Universe.