Still depressed

Lower than the Fed thought:

Aug 24 (Reuters) — U.S. inflation in the first half of the year was probably “markedly lower” than reported according to the San Francisco Federal Reserve Bank. Researchers at the regional Fed bank had earlier found that the very weak readings for economic growth in the early part of the year were likely due to inadequate adjustments for seasonal fluctuations. The same researchers applied similar methodology to inflation data and found that core PCE inflation was probably overstated by 0.3 and 0.2 percentage points in the first two quarters of the year, respectively.

This does nothing for output and employment:

China’s central bank pumps in billions to ease liquidity strainAug 25 (Xinhua) — The People’s Bank of China (PBOC) conducted 150 billion yuan (23.4 billion U.S. dollars) of seven-day reverse repurchase agreements (repo). The reverse repo was priced to yield 2.5 percent, unchanged from the yield on a net injection last week of 150 billion yuan using reverse repos, according to a PBOC’s statement. The PBOC also channelled another 110 billion yuan via its medium-term lending facility. Despite the cash injection the benchmark overnight Shanghai Interbank Offered Rate (Shibor) climbed by 1.3 basis points to 1.879 percent.

Not a good sign:

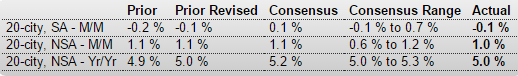

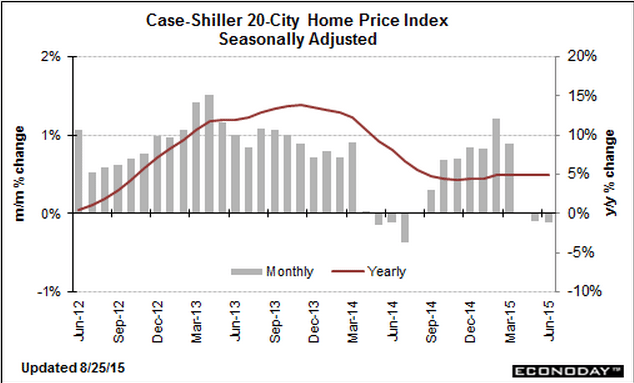

S&P Case-Shiller HPI

Highlights

Inventories may be low and sales rates firm, but both Case-Shiller and FHFA are pointing to a surprising flat spot for home-price appreciation. Case-Shiller’s 20-city adjusted index fell 0.1 percent in June vs Econoday expectations for a 0.1 percent rise. Year-on-year, 20-city prices, whether adjusted or unadjusted, are unchanged at plus 5.0 percent. This rate has been inching higher but looks like it may be ready to fall back unless prices pick up.

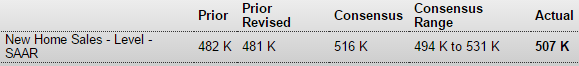

A bit less than expected and still at very depressed levels:

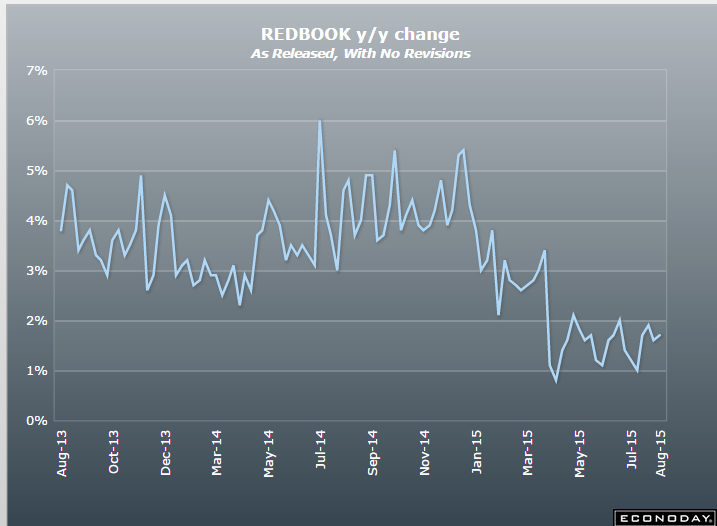

Settled back to depressed levels from last month’s blip up:

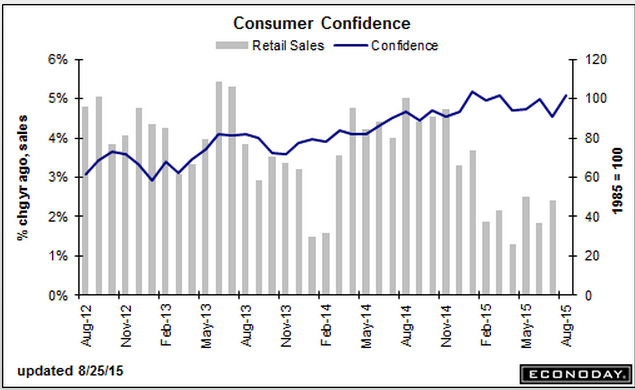

Consumer confidence bounced up with lower gas prices, as it’s one man one vote, not one dollar one vote, and so hasn’t been a reliable indicator of retail sales.

The post Redbook retail sales, Inflation adjustment, China, House prices, Consumer confidence appeared first on The Center of the Universe.