( click to enlarge )

( click to enlarge )Lion Biotechnologies Inc (NASDAQ:LBIO) definitely broke the downtrend channel and closed above the 9 & 13 EMAs for the first time since mid-July. Looking at the daily technical indicators, the momentum oscillators have now turned higher and especially the Slow stochastic indicator has issued a buy signal. Plus, the MACD and CMF show increasing upward momentum on daily chart and rising volume inflow. If momentum continues as I expect next week, there are lot of profits left on the table for traders to capitalize on. The price can move up to $8/8.50 in the short-term. This stock is on High alert for Monday.

( click to enlarge )

( click to enlarge )Baytex Energy Corp (NYSE:BTE) finally closed back above the $5 level Friday on strong volume. The stock was trading as high as $17 back in June and it appears that a massive potential bounce could be imminent. The RSI has just reversed off the 20% line and the MACD had a positive crossover. These two momentum indicators along with the rising STO is signalling that smart money has started to re-enter the stock. Plus, there was a steady increase in volume towards the end of the day, leading me to believe this stock is starting to attract some serious attention again. Stay tuned.

( click to enlarge )

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) With a high short interest ratio (short interest/average daily volume) of around 21.03 (days to cover) this stock is at the perfect price where positive news could send it on a big run. Volume is starting to pick up again and there could be a decent short covering if it clears next week the $7.50 level.

( click to enlarge )

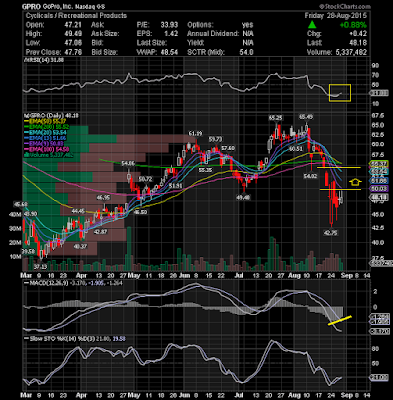

( click to enlarge )GoPro Inc (NASDAQ:GPRO) I think the stock may have bottomed and could be poised for a bounce back next week. Looking at the daily technical chart MACD-histogram is sloping up, indicating that the "bears" are losing momentum and RSI has just bounced off the 30 line (extreme oversold territory). If the stock price breaks the $50 level in the next sessions momentum traders are likely to send the stock up to $54.5 (100EMA). Keep it on your watch list going forward.

( click to enlarge )

( click to enlarge )Very bullish action on Lifelock (NYSE:LOCK) Friday. The stock made a very significant move in the last trading session closing above its 20-day EMA which could be signs of a bottom for the stock. Supporting this bullish bias are the technical indicators MACD, RSI and Slow Sto all showing buy signal. The stock seems to be forming a potential rounding bottom formation and its neckline is around 8.60. A close above this area would have positive implications and could drive the stock up to $10-10.64 in the short-term.. Keep the stock on your radar.

( click to enlarge )

( click to enlarge )The area comprehended between $8.8 and $10 represents a heavy resistance for shares of Ariad Pharmaceuticals, Inc. (NASDAQ:ARIA). A close above this key resistance area would have positive implications and could drive the stock much higher. Keep the stock on your radar.

( click to enlarge )

( click to enlarge )ZIOPHARM Oncology Inc. (NASDAQ:ZIOP) rallied with the market last week but the bounce stalled around the 9-9.30 level, which was a strong support for stock in the past now resistance. Short-term technical indicators are improving and the MACD shows a possible bullish crossover. If the stock can break above this key resistance area, it's worth a trade. ZIOP will move very quickly, so keep a very close eye on the stock.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC