( click to enlarge )

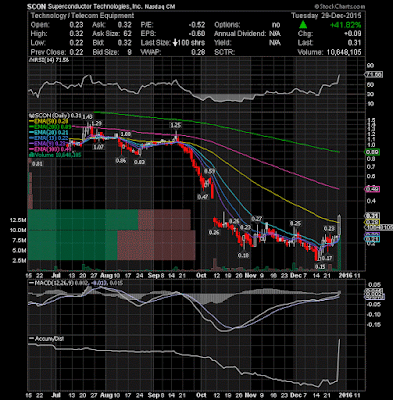

( click to enlarge )Superconductor Technologies, Inc. (NASDAQ:SCON) had a significant bullish momentum today, made a strong break out above its 50-day exp moving average as you can see on my daily chart above, which is very bullish. The stock is again setting up for a potential swing trade. From a technical standpoint, MACD and RSI have turned up and A/D indicator spiked upwards. Watch for continuation.

( click to enlarge )

( click to enlarge )Clovis Oncology Inc (NASDAQ:CLVS) is on the verge of really blowing up. I would not be surprised to see the stock test the $40 level at some point over the next few days. The daily technical chart sure shows a possible reversal in trend coming. Watch Wednesday's action for a possible breakout over $35.88. The technical indicators such as KD and MACD also show buy signal as %K line has just crossed on top over %D line and MACD is rising. The short-term trend is positive as the stock is trading upwards along with short-term EMAs.A break above the major resistance will confirm the bullish trend and the following uptrend will take price up to 42 zone initially.

( click to enlarge )

( click to enlarge )Nivalis Therapeutics Inc (NASDAQ:NVLS) closed back over the 20EMA and the volume was decent. The stock is forming a bullish MACD divergence on the daily chart, that's certaintly a sign that price can go up. I like this chart pattern and feel that NVLS will try to break through the 50EMA very soon. Keep a close eye on this stock, because once it breaks through, we should see a very fast, high volume move.

( click to enlarge )

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) had an unusually large spread accompanied with decent volume on the last trading day. However, today we saw some profit taking. The pull back should be seen as a natural and welcome movement. Option traders continue to target calls, so we could see further upside.

( click to enlarge )

( click to enlarge )Amazon (NASDAQ:AMZN) broke out to new 52-week highs today. I'm expecting to see the stock continue this move on Wednesday. As long as the stock stays above the rising 50EMA, the bullish scenario is still intact. Daily technical chart shows bullish sign with %K line on top of %D line and MACD on top of signal line.

( click to enlarge )

( click to enlarge )Starbucks Corporation (NASDAQ:SBUX) should be on your watch screen for the rest of the week. The stock has recovered nicely and closed today above its major EMAs on solid volume. I will be watching the stock again on Wednesday for a continuation move through Tuesday’s highs of $61.32. Looks like it is starting to turn.

( click to enlarge )

( click to enlarge )Weight Watchers International, Inc. (NYSE:WTW) gave us a nice move today, which could be the start of a bullish reversal and a short-term bottom. If the stock can break through the 50-day EMA at $20.06, we should see a strong follow through move. The accumulation chart is also moving up again with smart buying going on. Keep watching the stock.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC