( click to enlarge )

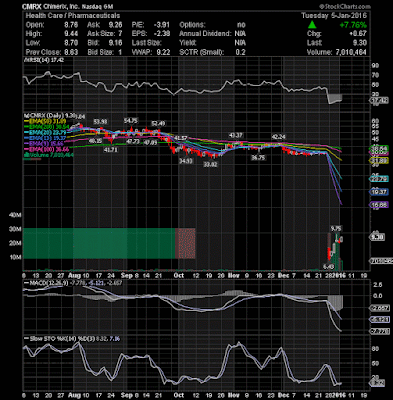

( click to enlarge )Chimerix Inc (NASDAQ:CMRX) looks to be working its way higher after a dramatic fall in price. Despite the general market's weakness, the stock made an impressive turnaround and rallied almost 8% to close the day at $9.30. Resistance for Wednesday’s move is $9.75, which reflects Monday’s high of the day. If the stock can break through resistance, we will have a two-bar reversal, which is very bullish for an upside move. The stock is still oversold as evidenced by the stochastics and RSI and MACD-histogram has ticked up, indicating that the bears are losing momentum, so there is still some chance that the stock may test double digits levels in coming days.

( click to enlarge )

( click to enlarge )GameStop Corp. (NYSE:GME) is very oversold and I would be looking for a technical bounce with initial resistance at $30.20. Keep the stock on your screen throughout the day on Wednesday.

( click to enlarge )

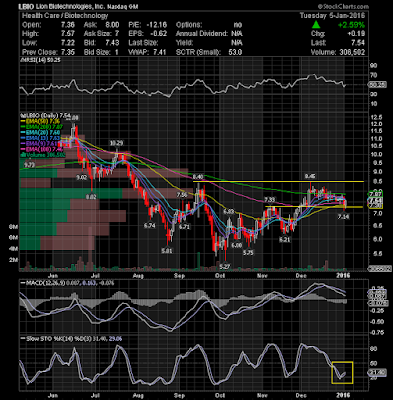

( click to enlarge )Lion Biotechnologies Inc (NASDAQ:LBIO) As long as the rising 50-day exponential moving average continues to hold up as support, a move to the bottom of the range can be seen as a healthy one. The slow stochastics show the stock is oversold with the possibility of a reversal. On watch.

( click to enlarge )

( click to enlarge )VMware, Inc. (NYSE:VMW) Watching for $57.61 (20EMA) breakout. All indicators are in favor of an upward price movement. MACD is rising and has generated a new buy signal today, so keep the stock on your radar for Wednesday’s trading day, as there is good upside potential in this move.

( click to enlarge )

( click to enlarge )Micron Technology, Inc. (NASDAQ:MU) needs to break this descending channel drawn by me on the daily chart before we see any sustainable rally. Momentum indicators are displaying a positive divergence. I'll be watching the stock on Wednesday, looking for a follow through move.

( click to enlarge )

( click to enlarge )Fitbit Inc (NYSE:FIT) ruled weak and also breached the crucial stop-loss level at $26.46. It may trade lower in coming days.

( click to enlarge )

( click to enlarge )3D Systems Corporation (NYSE:DDD) After posting steeper losses in the morning, the stock closed down just one percent on significant volume. If the stock breaks out above today's high, a buy order should be placed. It's a short squeeze candidate.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC