( click to enlarge )

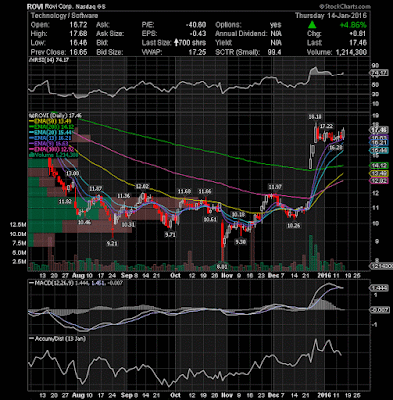

( click to enlarge )Rovi Corporation (NASDAQ:ROVI) is setting up nicely to break out. Buy point would be on the day it blows through $18.18 on heavy volume. Only a close below the $16.28 level negates the bullish scenario.

( click to enlarge )

( click to enlarge )Alcoa Inc (NYSE:AA) has printed its first bullish candle in seven sessions. With RSI in extreme oversold conditions, it is possible we could see a bounce up to its 9EMA at $8

( click to enlarge )

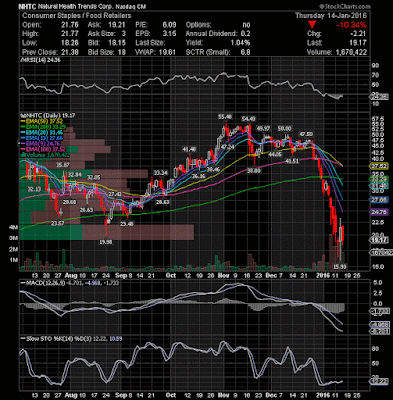

( click to enlarge )Natural Health Trends Corp. (NASDAQ:NHTC) There is a lot of volatility on the daily chart but I think the risk of continued downside here is a lot less than the possibility of a sharp oversold rally. Look for a push to $25 and then a possible test of $28 in the coming weeks. The stock remains in very oversold conditions and the upward move could be quick and impressive. On Wednesday, the Company’s Board of Directors has authorized an increase in its previously announced stock repurchase program from $15 million to $70 million, $10 million of which has already been completed. I'm Bullish at this point.

( click to enlarge )

( click to enlarge )Chipotle Mexican Grill, Inc. (NYSE:CMG) After being trading in a bearish tone for some time, the stock appears to making a comeback in favor of the bulls. A break above the declining EMA20 could trigger a rally towards 475 resistance and determine overall bias.

( click to enlarge )

( click to enlarge )Vringo, Inc. (NASDAQ:VRNG) If it breaks the upper line of this descending channel, it should take the stock to the area 2.32-2.35 area and possibly 2.52-2.65. MACD is forming a positive divergence on the hourly chart that is certaintly a sign that price can go up. On Watch.

( click to enlarge )

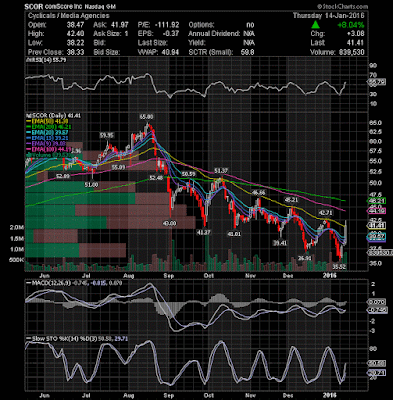

( click to enlarge )COMSCORE, Inc. (NASDAQ:SCOR) has finally closed above its declining 50EMA and it did so on heavy volume. The MACD indicator has just started to increase and the RSI is also showing positive signs . Stock price is expected to at least rally the next resistance at $44.19 and even go higher to test the next resistance level at $46.21

If you want to contact me for advertising opportunities on blog or twitter, then get in touch via email

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC