Wheeeeeee – that was fun!

Wheeeeeee – that was fun!

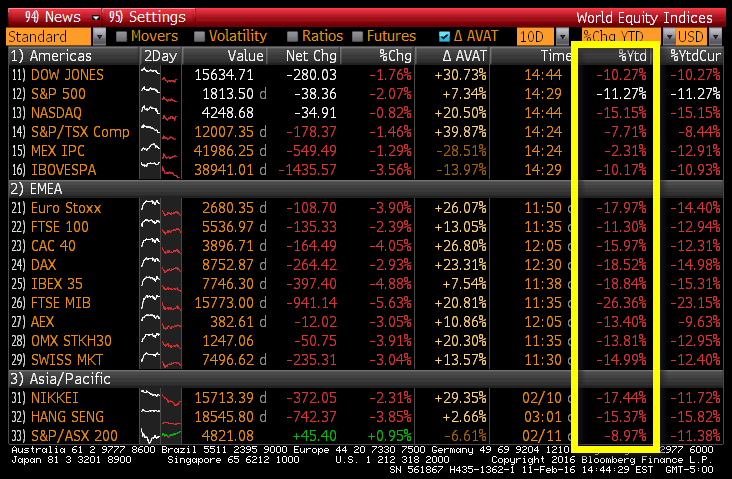

As the groundhog (who's name is Phil) predicted, we had 6 long weeks of selling to start off 2016 and, as of yesterday's close, we were teetering on the brink of a Global Bear Market after a 20% correction – as you can see from the Bloomberg chart on the right.

Things are so desperate out there that we find ourselves BEGGING for OPEC to cut production and raise oil prices – how crazy is that? It's crazy because it's idiotic an it's idiotic because we have become a nation… a planet of impatient idiots who can't bear to endure even a bit of discomfort – even if it's for our own good – if that good is delayed and the discomfort is immediate.

Sectors rotate, that's a fact. You can't have every part of an economy winning all of the time. It's OK for the banks to have a period of low earnings when the rates are low and they can't get a good spread lending to consumers. It's OK for oil companies to break-even selling $30 oil because the money the consumers would have spent on oil instead goes to the movies or the toy manufacturer or the hotel they can afford on their vacation.

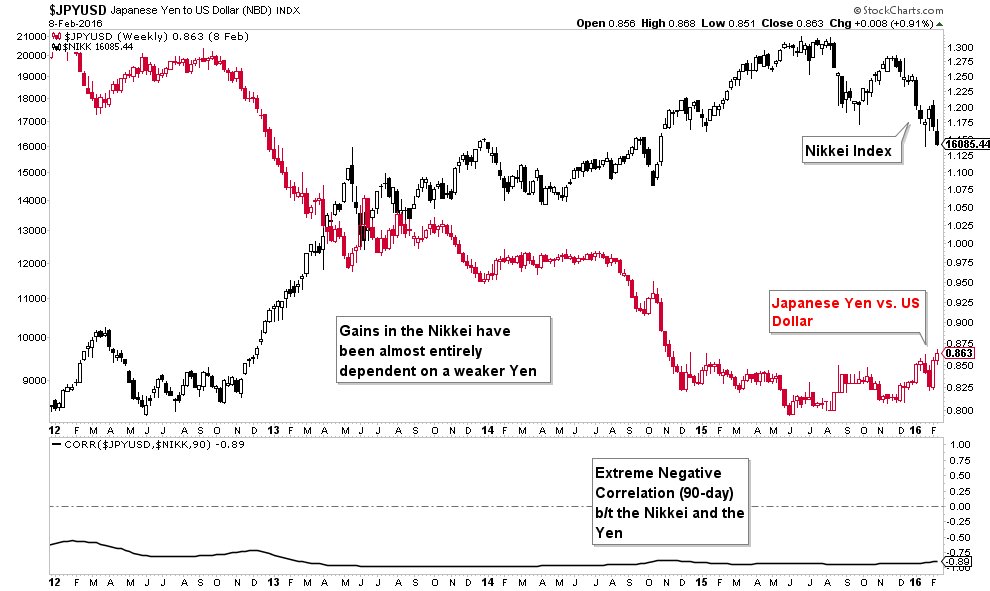

Avoiding economic pain leads to economic stagnation and THAT is the lesson we should be taking away from Japan's 20-year failed experiment in economic tinkering. They propped up their economy by making their currency worthless and that may help the Zaibatsu (the Corporate Conglomerate the runs the country) but it's been a complete disaster for the people, who have seen the buying power of their life savings drop by 35% in the last 3 years!

This week, worries about China and other Asian economies sent investors flying back to the relative stability of the Yen, which seems to have bottomed at 120 to the Dollar or 80 on $XJY. The problem is (and this is likely to surprise you) that the Yen, though a reserve currency, is less than 4% of the money in the World while Dollars are 63% and Euros are 22%. That means that when investors diversify more than 4% of their…