( click to enlarge )

( click to enlarge )SolarCity Corp (NASDAQ:SCTY) might face a period of sideways action while the stock consolidates the gains booked in the last trading sessions. It will face short to medium term resistance at $27.50. Once this level is crossed with good volumes, the stock can go to $30.

( click to enlarge )

( click to enlarge )Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA) had a nice move closing the day at $8.85. The stock hit a high of $9.02, which is resistance for Tuesday’s continuation move. I'm a buyer of MNTA once it breaks through this high and expect to see heavy volume push the stock higher. Keep the stock on your radar for Tuesday.

( click to enlarge )

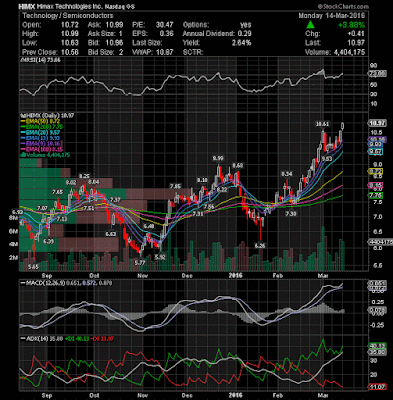

( click to enlarge )Himax Technologies, Inc. (ADR) (NASDAQ:HIMX) made a new 52-week high of $10.99. I think there is a good chance the stock will make another move on Tuesday. Resistance reflects Monday’s high. If the stock can break resistance, there should be opportunity for a good upside trade. The technical chart shows very strong upward momentum as the stock is trading above the 200-day exp moving average with both 50-day and 200-day exp moving average going up. At this point I'm buyer only once it breaks through today’s high of $10.99 for the continuation move with a tight stop. Stochastics and the RSI are overbought but remain bullish signaling.

( click to enlarge )

( click to enlarge )Corning Incorporated (NYSE:GLW) Flagging above the breakout. Next buy point when clears $19.59 on heavy volume.

( click to enlarge )

( click to enlarge )Advanced Micro Devices, Inc. (NASDAQ:AMD) was one of the few winners on today's session, as the stock closed up 20 cents on the day. The stock broke out of a trading range as it hit a high of $2.75 on the day. This high is now resistance for the continuation move. If the market continues to move up, this stock could be a big mover.

( click to enlarge )

( click to enlarge )Sunedison Inc (NYSE:SUNE) made a very strong reversal move with a solid upside volume. Today’s high of $2.25 is resistance for Tuesday’s continuation move. The daily technical chart shows the stock is due for a possible recovery as %K line is back above %D line showing positive momentum. On watch.

If you want to contact me for advertising opportunities on blog or twitter, then get in touch via email

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC