( click to enlarge )

( click to enlarge )Eleven Biotherapeutics Inc (NASDAQ:EBIO) In the last few sessions this stock has seen some dramatic gains. It was as low as $0.31 at the beginning of April and hit as high as $1.70 last week. The gains in just about 2 weeks came out to over 370%. The stock is currently overbought, but it could get more overbought closing the gap. It looks like MCUR might also have a great run so check the chart below for more details.

( click to enlarge )

( click to enlarge )Keep a close eye on this one. Macrocure Ltd (NASDAQ:MCUR) closed up over 14% yesterday on strong volume (nearly 10x avg). Let's take a detail look at the stock and see if the stock is worth buying. From a technical standpoint, the daily indicators point to MCUR being in an upward trend already. The MACD is now back above zero and +DI seems to be crossing up indicating bullish swing. This could be just the beginning of a breakout that could bring good returns. Plus, the stock is currently trading below cash levels. According to Yahoo, the company has around 1.80 cash per share or 30M and zero debt, which means that theoretically, investors are getting its business for free. With around 1.80 in cash, right now this stock is undervalued at 1.09 and the gain potential is not only good, but very accessible. Let's see if the history repeats itself (December 2015 massive gains). I'm long. You know, biotech small-caps are HOT, and the probabilities of any stock in this sector outperform any other asset, is very high.

( click to enlarge )

( click to enlarge )Sarepta Therapeutics Inc (NASDAQ:SRPT) has witnessed huge volatility in the past two sessions. The stock rose more than 35 percent on Friday after the FDA added a voting question to the agenda for the Monday meeting of the Peripheral and Central Nervous System Drugs Advisory Committee. So, everything can happen next week. In other words, the volatility will remain extremely high and you should invest/trade carefully or stay on sidelines till the near-term uncertainty subsides. This is the 30m chart with some key levels to watch next week. Good luck to all. I have no positions here.

( click to enlarge )

( click to enlarge )Carbylan Therapeutics Inc (NASDAQ:CBYL) is another stock on my watchlist. CBYL closed above its 20-day exponential moving average for the first time in nearly three months. It is seeing some significant volumes. I think the stock has a good chance to run to the 50-day EMA next week. On the daily time-frame, the MACD-histogram has been sloping up and the short-term EMAs have just ticked up to give a buy signal on the Impulse System. The slow stochastics and RSI are both rising, indicating bullishness. On watch.

( click to enlarge )

( click to enlarge )Plug Power Inc (NASDAQ:PLUG) looks about ready to pop here. The stock has finally recaptured the declining 200-day exponential moving average and closed the day near its high, with solid gains. Momentum indicators are bullish with RSI inching away above the middle level. The strongest sign of a bullishmomentum is the MACD indicator which is currently above the 0 line. Watching for $2.25 breakout. This momentum could push this stock much higher from here, so keep the stock on your radar for Monday’s trading day as there is good upside potential in this move. Short-term levels to watch 2.25 and 2.35.

( click to enlarge )

( click to enlarge )VirnetX Holding Corporation (NYSEMKT:VHC) is still trading in a range between 3.90 and 5. The direction for the stock remains unclear, but I still believe we will see some upward movement.

( click to enlarge )

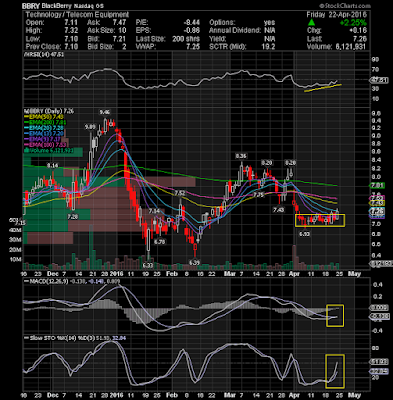

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) It looks like the buyers are finally aware of the buying opportunity at cuurent levels. Some positive divergences in the daily technical chart showing up. The MACD just gave a crossover buy signal and the Slow Sto is rising. We might have seen the bottom and ready for a sustain rally. I expect its up-move to continue and reach my first price target of 7.81 or 8.20 in the forthcoming trading sessions.

If you want to contact me for advertising opportunities on blog or twitter, then get in touch via email

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC